Tim Chitwood, VP of Agronomy

Price patterns show specific months in North America with historically significant price changes. “Summer fill” programs usually offer better fertilizer deals, particularly at the end of July and early August, considered a potential period for a pricing “reset.” This reset not only readies supply chains for the next season but also establishes a baseline for ingredient costs in the upcoming year. Some industry experts believe a reset might occur after the annual Southwest Fertilizer Conference (SWFC), a historic conference that recently completed its 97th year. Drawing over 2000 attendees from nearly 800 companies in late July, the SWFC is crucial for the fertilizer industry to trade crop nutrient inputs and share insights on trends and price movements. The 2023 SWFC may have hinted at relief for a much-needed reset in the 2024 season, following a record year in 2022 with historically high prices.

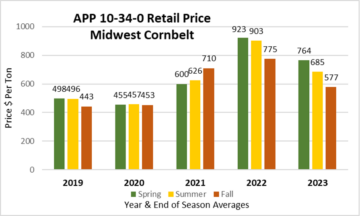

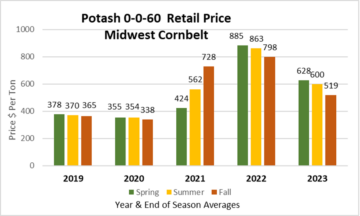

Unseasonal Trends. Data compiled from The Green Markets Report of Bloomberg, comparing the past five years, reveals fluctuations and seasonal trends in fertilizer prices. This report, with a history of over 45 years, assists professionals in making informed decisions. Covering nitrogen, phosphate, and potash markets weekly, it provides valuable market transparency. The report’s objective and unbiased fertilizer market data, drawing from over 300 independent price assessments, make it a trusted resource for comprehensive coverage of the global fertilizer industry. Attached are graphs created from Green Market Report data, presenting averages of Midwest corn belt retail pricing for three fertilizers grouped by seasons: Spring (April/May), Summer (July/August), and Fall (November/December).

Not just in time inventories. The COVID-19 pandemic caused unprecedented disruptions in the shipping industry, leading to congested shipping lanes and significant delays in transporting goods. Consequently, the cost of shipping containers soared to historic highs. For instance, the cost of shipping from China to the U.S. West Coast surged to $14,000 per container in January 2022 but dropped to $5,250 in the following months. The East Coast experienced a similar trend, with costs falling from $16,000 to $9,215 during the same period. Despite these challenges, supply chains and shipping lanes have gradually returned to some semblance of normalcy.

Global Competition Impacts. QLF Agronomy’s dedicated customers rely on the proven performance of L-CBF 7-21-3 MKP, a starter package featuring Monopotassium Phosphate (MKP), a unique P&K fertilizer source (0-52-34). This formulation ensures better plant starts, benefits to soil biology, and safe nutrient delivery. However, challenges have arisen due to increased demand for high-quality fertilizer sources like MKP, compounded by shipping difficulties and rising freight costs. MKP, primarily produced by China, Russia, and Israel, countries experiencing conflicts, faces geopolitical tensions and trade disputes, impacting global competition, driving costs up, and causing supply shortages.

Despite these challenges, QLF remains committed to its formulations, ensuring a consistent supply of essential phosphorus and potassium. Israel Chemicals Ltd. (ICL Group), the world’s largest MKP manufacturer, sets industry standards for quality, consistency, and pricing. While many fertilizer manufacturers saw significant profit margin increases in 2021-2022, ICL Group experienced a decline in gross profit in 2023. This trend reflects the volatility and impacts of the fertilizer market, suggesting a potential return to more normal price fluctuations within the industry.

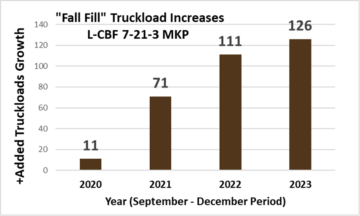

Fall Fill Possibilities. The recent QLF Agronomy “Fall Fill” promo was a big success once again. From September to November 2023, QLF made and delivered over 30% more fertilizer than in fall 2021. This shows a growing demand for fall fertilizer fills. Rising fertilizer costs at the end of the 2021 growing season drove this demand. Many users of Liquid Carbon-Based Fertilizer (L-CBF) noticed this trend and filled their tanks early to lock in prices. Confidence in the storability of L-CBF during winters has boosted this demand, with farmers taking charge of inputs sooner. In the past three falls (September to December), QLF sold and delivered an average of +103 more truckloads than each fall prior.

“Better is Better, Before More is Better”. The unique carbon-based starter, L-CBF 7-21-3 MKP, enhanced with QLF’s quality micronutrient blend CornSpike, has consistently shown positive agronomic returns over the years. In the recent 2023 season, another independent trial highlighted a substantial difference in dry down and achieved a noteworthy +24 Bu/A advantage in yield compared to another quality starter in the central Illinois region, especially noteworthy in a dry year.

The typical application rate for L-CBF 7-21-3 MKP in furrow for corn is 4 – 6 gallons per acre, with an extra quart of micronutrients. In 2019, the cost ranged from $3.80 – $4.30 per gallon. Over the next few seasons, it went up to $4.00 – $4.50 per gallon in 2020 and 2021. In the spring of 2022, due to ingredient costs, it rose to around $6.80 – $7.00 per gallon. By the spring of 2023, many secured the QLF starter for $5.80 – $6.30 per gallon. By fall 2023, QLF successfully lowered costs, providing the same premium starter for $4.80 – $5.20 per gallon. Despite ingredient cost fluctuations, the L-CBF 7-21-3 MKP didn’t change much on a per-acre basis. Considering the cost differences over a 5-year span and corn prices during those years, this premium in-furrow fertilizer wouldn’t cost a grower more than a bushel difference per acre.

Working Together. QLF has invested significantly in expanding manufacturing plants and onsite fertilizer storage capacity, ensuring ample ingredient supplies. This expansion is in response to the growing demand for L-CBF, overcoming supply chain disruptions, and addressing the challenges in our country’s logistics landscape. With a shortage of skilled truckers and reliable transportation, it’s crucial for farmers to support trucking efforts. Many QLF Agronomy customers have taken advantage of promotions to invest in larger tanks and upgrade on-farm storage capacity, reducing the trips needed to meet seasonal needs and allowing for better purchasing opportunities. Proactive customers taking early deliveries can alleviate strain on the supply chain, contributing to smoother operations. Collective efforts can enhance the resilience and efficiency of the supply chain, preventing bottlenecks and unnecessary shortages that may contribute to price increases. QLF urges all partners to support the diligent work of the QLF Transportation department in ensuring efficient and timely delivery of L-CBF needs ahead of schedule.